- CONVERTING FROM IBANK TO QUICKEN FOR MAC FOR MAC

- CONVERTING FROM IBANK TO QUICKEN FOR MAC SOFTWARE

- CONVERTING FROM IBANK TO QUICKEN FOR MAC PROFESSIONAL

- CONVERTING FROM IBANK TO QUICKEN FOR MAC DOWNLOAD

If you previously uploaded an iBank document to the Cloud Sync server and want to connect to it, click this option. Next, iBank will prompt you to add accounts to the document: please see About Accounts for more information. Both sets include categories that are assigned standard US tax codes.

CONVERTING FROM IBANK TO QUICKEN FOR MAC PROFESSIONAL

iBank includes two predefined sets of categories: "Home" is intended for personal use, "Business" for professional use. On the next screen, you will be asked to choose which categories you would like iBank to add to your document. The next screen will ask you to choose a location in which to save your document: click "Continue," enter a name for the document in the sheet that appears, choose a location, and click "Save." Choose one of the following options to determine how iBank should set up the new file: Start FreshĬhoose this option and click "Next" to create a new iBank document. This assistant opens automatically the first time you launch iBank 5, as well as any time you create a new document. Choose File > New iBank Document to start the new document assistant: To get started using iBank, the first thing you will need to do is create a document. Now that Quicken has more Mac functionality than Banktivity, budgeting that works, and Banktivity has gone to the subscription model I will go back to Quicken.Creating a Document How do I create documents in iBank? I bought Banktivity to have Mac based accounting and avoid Quickens subscription pricing. Further, budgeting relies on scheduled transactions and if the amount of a scheduled transaction changes, you have to create a new transaction (and keep the old one), otherwise your historical budgets will change. Bad design that could cause someone to easily overspend. For example if you budget $200 every other month but then spend $100 in a month that was originally budgeted for 0, the product does not include the $100 in the monthly expenses total. You are not allowed to have a monthly budget of $0. Budgeting is REALLY important for me and being able to review accurate results guide my spending. So I always had to be on the lookout for errors and create adjustment tranasctions that cause downstream reconciliation problems.īudgeting is a whole other case. The temporary fixes they gave me didn't work and they have never provided a fix. I have had five times when the accounts didn't total correctly and it was easily proven by totalling manually from the last reconciliation. Too bad they ruin it with poor sup-port and some bad design. This company has the basics of a good product. Just fix the program instead of letting this problem fester. This level of customer support from any company is disgusting. They are now switching to a subscription model so I might as well try the new improved Quicken and try not to think of the $70 and many many hours wasted on this turd. I have contacted customer support who told me to send screen shots and log files which I did, but got no response.

CONVERTING FROM IBANK TO QUICKEN FOR MAC SOFTWARE

So who are you going to vote for-Chase with millions of people using other banking software without problems or this little software company with limited resources and a history of buggy software? (Does anybody remember iWork from the same company?) There are other problems such as the impossibility of paying two credit cards that are issued by the same company-both payments get sent to one account and then you get a late fee and a ding to your credit score.

They have said it's not their problem and to call Chase, I call Chase and they say it's not their problem. So I have to painstakingly check the Banktivity record against that of Chase and manually enter the missing transactions. I have had numerous interactions by e-mail and chat, sending log files and screen shots, with their vaunted customer support staff and this problem continues.

CONVERTING FROM IBANK TO QUICKEN FOR MAC DOWNLOAD

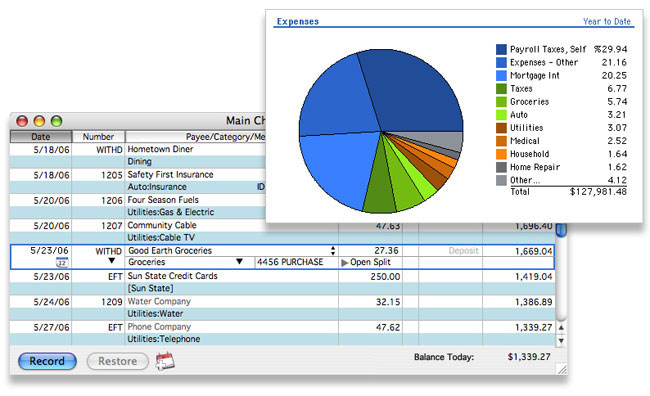

However, IT DOES NOT RELIABLY DOWNLOAD BANKING TRANSACTIONS from Chase. I use this type of software to pay bills, flagging tax-related items as I pay them, and generating a simple report at tax time each year.

CONVERTING FROM IBANK TO QUICKEN FOR MAC FOR MAC

Like many people I have been forced to check out alternatives to Quicken 2007 for Mac since its demise. Banktivity is a beautiful app with problems.

0 kommentar(er)

0 kommentar(er)